pay indiana sales tax online

Note that Indiana law IC 6-25-2-1c requires a seller without a physical location in Indiana to obtain a registered retail merchants certificate collect and remit applicable sales tax if the. Know when I will receive my tax refund.

For those who meet their sales tax compliance deadlines Indiana will offer a discount as well.

. County Rates Available Online. Indiana county resident and nonresident income tax rates are available via Department Notice 1. For those collecting less than.

Exemptions to the Indiana sales tax will vary by state. The penalty information can be found in Section IC 6-81-10-1 of the Indiana Tax Code. DOR offers customers several payment options including payment plans for liabilities over 100.

The discount varies depending on the size of what was collected. Here are your payment options. Find Indiana tax forms.

Find Indiana tax forms. In 2017 that rate fell to 323 and has remained there for the 2019 tax year. The Indiana income tax system is a pay-as-you-go system.

The Indiana sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the IN state tax. You can remit your tax bill. 10 times 07 equals 70.

File online at the Indiana Department of Revenue. Know when I will receive my tax refund. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail.

Notice of New Sales Tax Requirements for Out-of-State Sellers. For example Widget A costs 10. Sales Tax - Click to Expand.

Because Indiana does not have a discretionary tax local sales tax on most goods simply multiply each dollar by 7 percent. You do not need to pay sales tax for last month 201000 because you had not previously met the requirement to begin collecting sales tax and therefore you werent. All businesses in Indiana must file and pay their sales and.

Overview of Indiana Taxes Indiana has a flat statewide income tax. Your browser appears to have cookies disabled. You have a couple options for filing and paying your Indiana sales tax.

Pay online quickly and easily using your checking or savings. Payments for monthly taxes are due on the 20th day of the month following the close of sales. Cookies are required to use this site.

The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business. Note that Indiana law IC 6-25-2-1c requires a seller without a physical location in Indiana to obtain a registered retail merchants certificate collect and remit applicable sales tax if the. How to File and Pay Sales Tax in Indiana.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Which should be attached. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Many taxpayers have enough taxes withheld from their income throughout. Streamlined Sales and Use Tax Project. For transactions occurring on and after October 1 2015 an out-of-state seller may be.

Indiana Will Start Online Sales Tax Enforcement Oct 1 Eagle Country 99 3

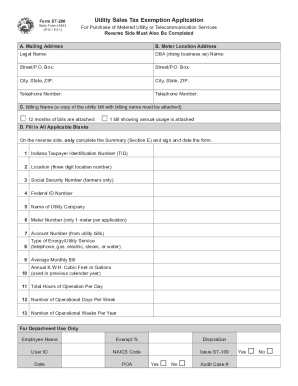

Indiana State Form Sales Exemption Fill Out And Sign Printable Pdf Template Signnow

Indiana To Tax More Out Of State Sellers Under New Economic Nexus Law Avalara

Tax Credit Online Marketplace Creates Connections For More Deals Indianapolis Business Journal

Sales Tax By State Is Saas Taxable Taxjar

Oops Here S What To Do If You Missed The Tax Deadline

Indiana State Taxes 2021 Income And Sales Tax Rates Bankrate

/cloudfront-us-east-1.images.arcpublishing.com/gray/3GCBE5RSSRGJHLQNNZUKHC4T7M.jpg)

Indiana Shoppers Will Soon Pay Online State Sales Tax

Holiday Shopping Online What You Need To Know About Sales Tax

Sales Tax Laws By State Ultimate Guide For Business Owners

![]()

Dor Indiana Department Of Revenue

Owe State Taxes Here Are Your Payment Options Wbiw

How To File And Pay Sales Tax In Indiana Taxvalet

Bill Would Require Online Sellers To Collect Sales Tax

St 103 Pdf Fill Online Printable Fillable Blank Pdffiller

State Revenue Officials Remind Hoosier Tax Payers Of Ways To Pay As Deadline Looms